Investing for the long term: 5 essential tips

There are some simple steps for long-term investments. At least as of date, such investments are totally tax-free. We should understand the basics of such investments.

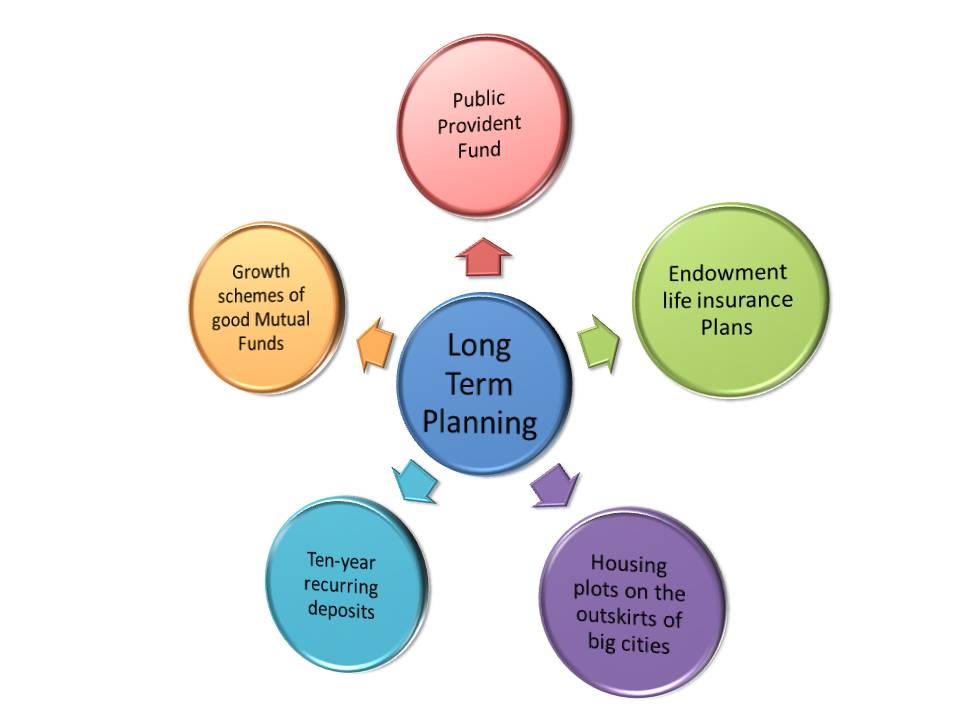

We need to factor in several scenarios when we talk about long-term investments. These long-term investments can and should be spread over a period of three decades and it is quite possible to reap rich rewards at the close of the long-term period. We also need to understand that it is wise to always think of the long-term, as the risks are spread out and since India is one of the fastest growing economies of the world with a stable democratic set-up, we can always understand that it does pay to invest in the long-term. Be that as it may, it does pay to invest in: This is a fifteen-year deposit scheme, and the entire amount deposited, up to a maximum of Rs.1,50,000 in a financial year, is totally exempted from the total income under section 80(C) of the Income Tax Act. The biggest advantage of this scheme is that the entire amount that grows at a rate of around seven per cent per annum, is totally exempted from Income tax. The rate of interest keeps on varying, but the average is seven per cent. It is the only scheme, that offers totally tax-free income. It can also be opened in the name of the minor and can be taken out when the child becomes a major. Thus, even Rs.500 invested per month, would come in really handy, as the amount saved would be Rs.90000, and the interest is paid on the total balance every year. One can vary the amount every month as well. PPF can be extended in a block of five years after fifteen years. Hence, it is wise to open two accounts -- one in the name of the child, and another in the name of either parent and keep on accumulating whatever is possible in the PPF account, by investing the savings in the PPF. It is a truly wonderful scheme that will enable the individual to have a good corpus at the time of retirement. Given the glorious uncertainties of life, it does pay to invest in Endowment Plans of the LIC or good Corporate Houses that also run good life insurance schemes. For example, the ICICI Bank or the Tata Group. It is quite true that the bonus is added every year and the total interest, in terms of return on investment, is very little. Yet, when the person is just twenty years old and the endowment policy for ten hundred thousand rupees is taken, for a three-decade period, the premium will be very small and the amount that the individual will get will grow to at least twenty-five hundred thousand rupees, at the end of three decades. This tax-free amount can be reinvested in the bank at a rate of at least 7 per cent interest. Coimbatore, Vijayawada, Tiruchirappalli, Madurai, Ranchi, Indore, Vizag, and Kochi are the big growth cities, The huge metro cities are already overcrowded. On the outskirts of these cities, it is still possible to find areas, where the housing plots are still quoted at reasonable rates. It should be noted that over a two-decade period, these areas would boom and the investment would fetch very good returns. Guduvancheri, near Chennai (almost fifty kilometers in South Chennai) is a classic example. A plot of good land in the year 1991, was just fifty thousand rupees. Today, the same plot costs 1.5 crore rupees. Similar growth rates can also be expected in the aforesaid cities. The investments are thus very safe long-term investments. At the moment, senior citizens enjoy a tax exemption of up to Rs.50,000 in interest earned through fixed deposits and savings deposits in banks. The ten-year recurring deposits are ideal long-term investments, as the returns will enable one to meet emergency expenses and feel a little more comfortable when the going becomes very tough at the time of a recession or high inflation or job loss, and so on. At the moment, the HDFC Mutual Fund and the ICICI Mutual Fund, have very good schemes where the amount invested fetches a good return. The trick is to split the deposits and invest in a spaced manner. The investment in such growth schemes should be Rs.10000 at a time. It should be noted that an amount of up to one hundred thousand rupees, in the form of interest is exempted from income tax if the amount is realized after a period of one year. That is, t is wise to take out the deposit amount when the cumulative interest is around ninety thousand in that particular financial year. Any amount greater than this amount is taxed at the appropriate rates. It is wise to consult a good investment advisor in this respect. The aforesaid discussion is meant to illustrate some long-term investment schemes. It is always fine to start somewhere and be very cautious in investing. And long-term investments are always good.Introduction

Public Provident Fund(PPF)

Endowment life insurance Plans

Housing plots on the outskirts of big cities

Ten-year recurring deposits

Growth schemes of good Mutual Funds

Conclusion

This is an exhaustive article on investment strategy especially long term investment.

There are some long time investments like government/PSU non taxable bonds, gold bonds, select mutual funds, equity shares of good companies, PPF scheme etc in which generally a good return is obtained by the investor.

In a falling interest rate regime, the long term investments made earlier at the time of good interest rate give a very good return to the investor. At the same time in an increasing interest rate regime the investor can withdraw the earlier investments and then invest in the present offers.